Title loans with bad credit score provide a quick cash solution in San Antonio, offering short-term secured loans based on vehicle titles instead of credit checks. With online applications, same-day funding, and flexible payments, they cater to those with low credit ratings who need urgent funds, but come with high-interest rates and default risks that require careful consideration.

“Considering a title loan but worried about your low credit score? This guide breaks down what to expect in the world of title loans for those facing financial challenges. First, we’ll explore what these loans are and how they work, offering a clear understanding. Then, we’ll navigate the obstacles individuals with bad credit may face during the approval process. Subsequently, we’ll delve into the potential benefits and crucial considerations for borrowers, ensuring you’re informed before making a decision.”

- Understanding Title Loans: A Quick Overview

- Challenges of Getting Approval with Bad Credit

- Benefits and Considerations for Borrowing Despite Low Scores

Understanding Title Loans: A Quick Overview

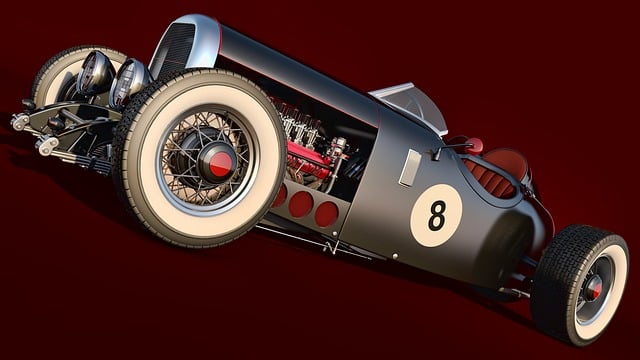

Title loans have emerged as a popular option for individuals seeking quick cash, especially those with less-than-perfect credit. This alternative lending method allows borrowers to use their vehicle’s title as collateral in exchange for a short-term loan. Unlike traditional bank loans or credit cards, title loans don’t typically require extensive credit checks, making them accessible to people with low or bad credit scores. This feature makes title loans an attractive solution for San Antonio Loans, providing a safety net during financial emergencies.

The process is generally straightforward and efficient. Borrowers can complete an Online Application, which usually involves filling out basic personal information and details about their vehicle. Upon approval, the lender will provide Same Day Funding, ensuring that funds are readily available when needed. This rapid turnaround time makes title loans a convenient choice for those who need cash in a hurry without sacrificing accessibility or flexibility.

Challenges of Getting Approval with Bad Credit

Getting approved for a loan when you have a bad credit score can be challenging, especially with traditional financing options. Lenders often require excellent or good credit to mitigate risk and ensure repayment. However, when it comes to a title loan with bad credit score, things operate a bit differently. This type of loan is secured by your vehicle’s title, which acts as collateral, offering lenders some peace of mind.

In the case of Dallas Title Loans, for instance, even if your credit history reflects missed payments or high debt, the focus shifts to the value and condition of your vehicle rather than your credit score. As long as your vehicle is in good working order and has a clear title, you can keep it with you throughout the loan process (Keep Your Vehicle). This alternative approach makes it possible for individuals with poor credit to access much-needed funds quickly and conveniently.

Benefits and Considerations for Borrowing Despite Low Scores

When considering a title loan with bad credit score, it’s important to understand both the benefits and considerations at play. One advantage is that these loans often offer faster access to funds compared to traditional bank loans or personal loans from financial institutions. This can be particularly appealing for individuals who need immediate cash, such as those facing unexpected expenses or emergencies. Additionally, with a title loan, your credit score isn’t the sole factor lenders consider; they also evaluate the value and condition of your vehicle—a significant asset that can secure the loan.

Another perk worth noting is the potential for flexible payment plans. Many lenders provide semi-truck loan refinancing options tailored to borrowers’ financial capabilities. This flexibility allows you to spread out repayments over a more extended period, making it easier to manage cash flow. However, it’s crucial to be mindful of potential drawbacks, such as high-interest rates and the risk of defaulting on the loan if payments become unaffordable. Thoroughly understanding the terms and conditions is essential before securing any title loan with bad credit score, ensuring you make informed decisions that align with your financial goals and capabilities.

A title loan with bad credit score can offer a temporary financial solution, but it’s crucial to understand the associated challenges and benefits. While traditional loans may be out of reach due to low credit scores, title loans provide an alternative option, allowing borrowers to access funds quickly. However, high-interest rates and potential risks highlight the need for careful consideration. By weighing the pros and cons, individuals can make informed decisions and navigate their financial options effectively.